EROAD 1H19 Focus on investment for next level of growth

EROAD 1H19 Focus on investment for next level of growth

EROAD HALF YEAR 2019 ANNOUNCEMENT AND UPDATE

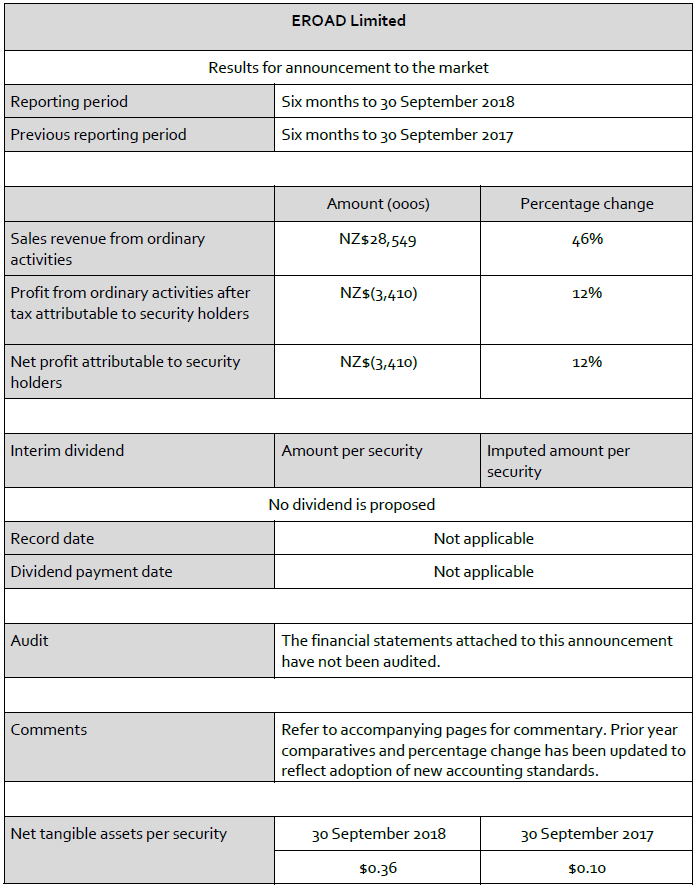

Integrated technology and services provider EROAD Limited (NZX:ERD) announced continued progress in the first half of the financial year to 30 September 2018, whilst it invested to scale for the next level of growth.

Highlights for the six months to 30 September 2018, and business update 1

- Revenue rose to $28.5m, up 46% over the same period last year, and operating costs were up 38% to $22.3 million

- EBITDA of $6.2m during the period, up 81% compared to $3.4m (restated) in the first half of FY2018

- Net loss before tax of $3.6m, influenced by continued investment in the business, including a number of operating expenses, as well as changes to accounting treatment

- Total Contracted Units in New Zealand/Australia grew to 65,285, up 31% on the same period last year

- Total Contracted Units in North America rose to 20,955, up 115% on 30 September 2017 (36% annualised growth over the last six months)

- Customer retention rate remains strong at 98%

- Future Contracted Income grew to $115m during the period, up 40% compared to the same period last year.

- New service launched for civil contracting and construction sector enabling easy tracking for powered and non-powered equipment and assets and efficient contract reporting

- Solid pipeline for NZ business for second half FY19 with enterprise customers signed during the six months for installations continuing into 2019

- Enhanced and expanded the senior leadership team at the EROAD group level and in the US to support future growth

- Graham Stuart assumed chairmanship of EROAD’s board of directors, succeeding Michael Bushby, who remains on the board

- EROAD won Exporter of the Year to the USA in the $1 million to $10 million category at the American Chamber of Commerce in New Zealand AmCham DHL Express Success & Innovation Awards.

- EROAD won EY Debt Deal of the Year at the INFINZ 2018 industry awards for its $48 million multi-option credit facility with BNZ to support customer leasing of in-vehicle units

- EROAD included at #7 on the Master of Growth Index in the Deloitte’s Fast 50 with 415% growth between FY14 and FY18

1 Note the numbers presented above reflect EROAD’s new accounting treatment, explained in more detail below and in the Financial Statements included within EROAD’s half-year report.

Half-year to 30 September 2018

EROAD’s total contracted units grew to 86,240, up 45% on the same period last year, supporting revenue growth of 46%. During the period, the company achieved an EBITDA margin of 22.0%, compared to 17.5% a year ago. EROAD’s loss of $3.6 million before tax for the half-year reflects continued investment and higher operating expenses during the six-month period (including some special items as outlined in the accompanying results presentation) as well as the adoption of new accounting standards. EROAD’s Future Contracted Income rose 40% on a year ago to $115 million.

Alongside continued revenue growth, EROAD faced higher costs during the six months as the company boosted its senior leadership team (including an expansion of its US team), to enable higher levels of growth. EROAD also invested in laying the groundwork for its relaunch in Australia and commenced an upgrade of its business systems. In addition, there were one-off professional services fees incurred due to conducting detailed due diligence on a possible acquisition which ultimately the company decided not to pursue.

EROAD Chairman Graham Stuart said “New Zealand momentum remains strong and has given us the confidence to extend our market presence in Australia. We are happy with the performance of our New Zealand business, but we can’t afford to be complacent as the market is changing and EROAD needs to invest to keep ahead.”

“Unit sales in North America fell short of our expectations for the six months,” he said. “While disappointed, we did anticipate a moderation in growth following the rush leading into the ELD December 2017 deadline and the elevated quarter thereafter. Early progress from our strategy refresh gives us confidence in future plans, and we continue to track towards positive operating cash flows in the US.”

“This year we are investing ahead of revenue globally to put the people, systems and processes in place for the next stage of EROAD’s growth. This investment is consistent with the plan outlined at the time of the capital raise completed in February 2018. Our focus is on an ability to continue to scale quickly, as well as R&D, to continue to improve our value proposition to existing customers and to target new market segments,” he said.

Operational summary

New Zealand & Australia

Total contracted units in New Zealand and Australia grew to 65,285 at 30 September 2018, a growth rate of 31% since 30 September 2017. Enterprise clients signed late in the period, and with units yet to be installed, provide a solid pipeline for the second half of the year. Customer retention remains strong, with high levels of contract renewals by enterprise customers. In addition, almost half of customers renewing their service plans are upgrading to Ehubo2 units, enabling the provision of additional services, including health and safety services.

EROAD chief executive Steven Newman said “New Zealand growth remained solid in both electronic RUC and health and safety services, particularly among enterprise customers with sizeable fleets, as well as among local bodies and council fleets.”

During the six months EROAD reached a decision to re-launch in the Australian market.

“We have recruited dedicated sales staff in key states in Australia to take advantage of what we see as a growing opportunity in this market, while at the same time leveraging heavily off our New Zealand capabilities” said Mr Newman.

“We believe the time is right for a measured, proactive expansion in Australia. The health and safety compliance environment, including chain of responsibility rules, is as relevant as it is in New Zealand. Moves towards other regulatory services, such as fringe benefit tax, fuel tax credits and electronic work diaries, are gaining momentum. Further out, interest in road user charging is increasing”, said Mr Newman.

North America

EROAD commenced its North American strategy refresh during the six months (completed in October 2018) to identify submarkets to focus on where its capabilities are well matched, and which offer higher returns on investment.

Growth in unit sales moderated from last year’s very high levels. Although Total Contracted Units in NA grew to 20,955 units, up 115% since 30 September 2017, sales in the last six months, though continuing at higher levels than pre-ELD, fell short of expectations. NA units increased by 36% (annualised) in the six months to 30 September 2018. The 3,198 units added were 12% below the comparative six month period for the FY18. After a flat period in the market following the December 2017 ELD deadline, the ELD market is transitioning to a longer-term, continuous sales cycle, with customers adjusting their focus to acquire additional products that go beyond the minimum ELD requirements.

Mr Newman said that “EROAD’s strategy refresh in North America had confirmed the company was on the right track and the company would focus its sales programme on targeted geographies and industry verticals. For example, EROAD was releasing hours of service rulesets for specific product verticals where the company believed it had a competitive advantage. The first such ruleset was for oilfields, released in September 2018, and EROAD has already signed up initial units for this product.”

Change in accounting treatment

EROAD has elected to adopt early the new lease standard NZ IFRS 16 in conjunction with NZ IFRS 15 which was effective from 1 April 2018. While under the existing lease standard NZ IAS 17 many of EROAD’s customer contracts meet the definition of a lease and, therefore, lease accounting as a lessor was applied, these same contracts do not meet the definition of a lease under NZ IFRS 16. The contracts would, therefore, be accounted for as service contracts under NZ IFRS 15.

This represents a significant change in the way the company recognises revenue and costs relating to its contracts with customers. Most significantly, the company no longer recognises upfront revenues for outright sales, installation services, sale of accessories or finance leases. EROAD now recognises these revenue streams evenly over the contract term, typically over 3 years. Other impacts from adopting the new accounting standards include a reduction in the capitalisation of costs associated with establishing the customer contracts. Results presented for this half year, as well as comparative numbers for the last financial year and last half year have been restated to reflect these changes. More detail on this change is available in the Financial Statements included within EROAD’s half-year report.

Mr Newman said that while the impact of the change in the accounting standard had a negative impact on prior year comparative results, “the new accounting standards have the benefit of producing financial numbers that more closely reflect true cash flow in the business as hardware related revenue decreases over time and EROAD more closely resembles a SaaS subscription business.”

Outlook for full year to March 2019

EROAD expects steady growth in NZ to continue through the second half of the year. A solid pipeline of already contracted unit installs by new and existing enterprise customers is expected to provide continued growth in NZ. Due to additional costs in Australia as we build in-market sales capability, that investment will run ahead of revenue in the near to medium term. As EROAD is adopting a measured approach, leveraging its NZ operations, a substantially smaller investment is required than with a traditional new market entry.

Mr Newman said EROAD “would continue to incur higher operating expenses for the near term as it invested ahead of its growth curve. This is so that the company was well-placed to continue to meet and exceed customer expectations and be able to scale quickly as its customer base continues to grow.”

“This includes a major overhaul of our business systems to improve customer experience and maintain our competitiveness,” he said.

“The opportunity in North America for the EROAD platform, which combines regulatory-driven telematics with commercial services, continues to develop positively”, said Mr Newman.

“We are establishing a scalable platform for growth. We have a strong local leadership team in place to drive scale. We have the people, products and increasingly the ability to win target customers”, he said.

Financial Statements

Attached to this release are the unaudited financial statements, for the six months ended 30 September 2018 and the comparative financial information for the six months ended 30 September 2017. These financial statements have been prepared under the New Zealand equivalents to International Financial Reporting Standards and reviewed by KPMG.

For a detailed description of EROAD’s business, and terms including Total Contracted Units, Future Contracted Income and Retention Rate, which are non-GAAP measures used by EROAD to manage the business, please refer to the Appendix of the November 2018 Half Year Presentation.

For further information:

Steven Newman CEO

EROAD Limited

+64 9 927 4747

Email: steven.newman@eroad.com

About EROAD

EROAD was established in 2000 to develop an electronic solution to modernize New Zealand’s paper- based Road User Charges (RUC) system. EROAD now helps its customers meet their ever-increasing regulatory and fleet management requirements with an easy to use system.

EROAD’s services include road charging and tax compliance, health and safety improvement, and fuel, fleet, and vehicle management solutions. These services benefit our customers, as well as communities and the wider public, through encouraging safer driving practices, and providing valuable data analytics across the road network to help improve the planning, maintenance and management of our roads.

In the last year EROAD’s platform has supported journeys of more than 3.2 billion kilometres travelled by trucks and light vehicles in New Zealand, Australia and the United States of America. EROAD collects more than 80% of heavy vehicle RUC collected electronically in NZ, around $0.5 billion annually. EROAD introduced the first electronic Weight Mile Tax (WMT) service in the USA in 2014, and the first independently-verified, comprehensive Electronic Logging Device (ELD) service in 2017.

EROAD has built a well-established business in New Zealand that is now a vital part of the transport ecosystem. The company is investing to expand its business in New Zealand, Australia and North America to pursue significant growth opportunities. EROAD continues to deliver intuitive solutions to serve our communities and help our customers, government agencies and stakeholders succeed. We work closely with customers and government agencies to understand both customer needs and regulatory frameworks to ensure our solutions are mutually-beneficial for all parties. We believe every community deserves the peace of mind of safe roads, and efficient and sustainable road transportation. That is why we develop easy to use, accurate, and reliable solutions that solve complex transportation problems.

Attachment: EROAD Half Year Report (including financial statements)